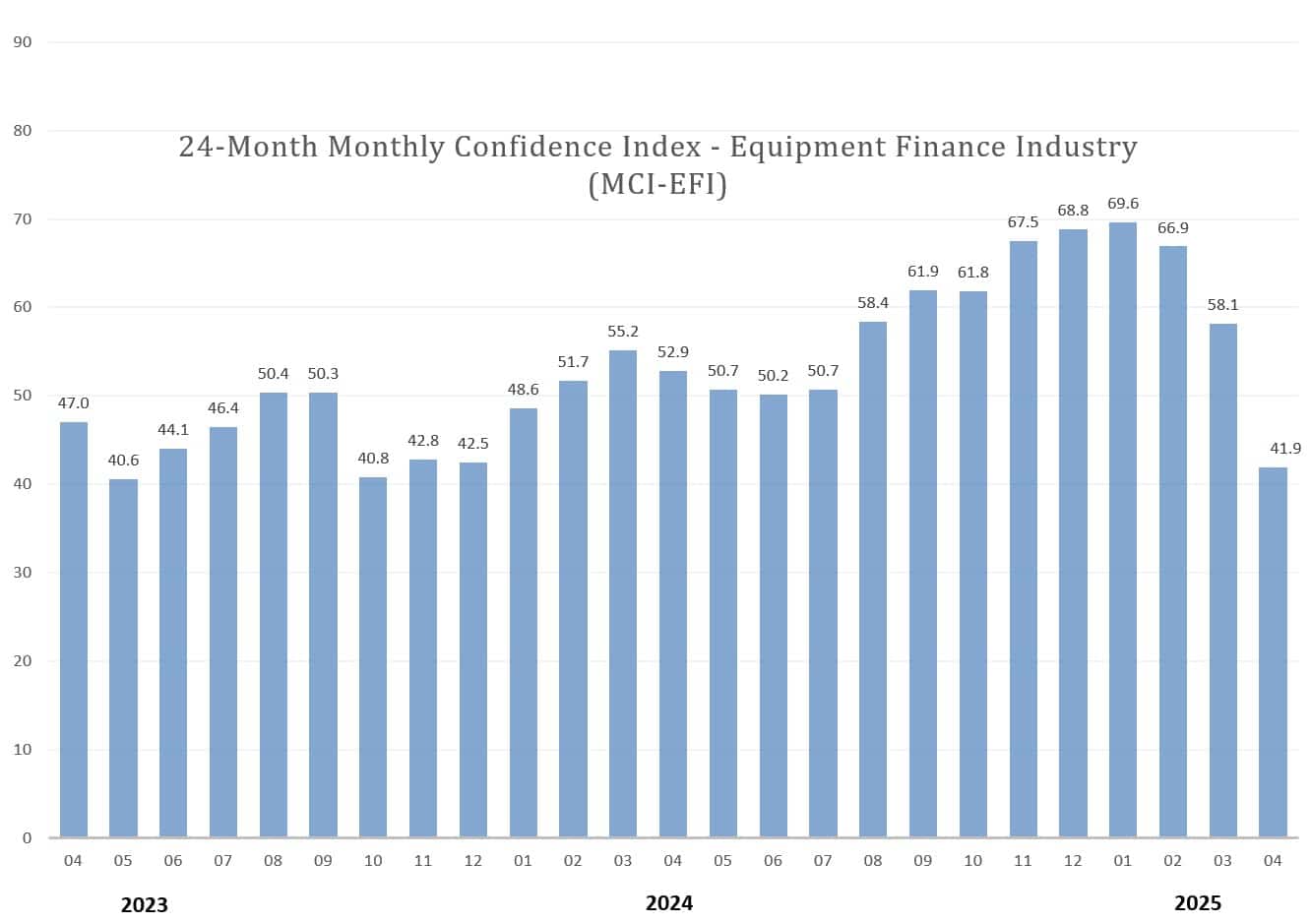

The Equipment Leasing & Finance Foundation (the Foundation) releases the April 2025 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. Overall, confidence in the equipment finance market is 41.9, down from the March index of 58.1, and the lowest index since October 2023. The index reports a qualitative assessment of both the prevailing business conditions and future expectations as reported by key executives from the $1.3 trillion equipment finance sector. Approximately half of the survey responses were submitted prior to the tariff announcement on April 2.

When asked about the outlook for the future, MCI-EFI survey respondent Charles Jones, Senior Vice President,1st Equipment Finance, Inc., said, “Turbulent times…doom and gloom mixed with increased opportunities. Tariffs could lead to higher prices for parts and equipment. They also will result in “creative” financing opportunities to help borrowers protect cash flow and offset higher prices for goods. Once you get past the fear, it’s an exciting time to be in equipment finance.”

April 2025 Survey Results

The overall MCI-EFI is 41.9, down from the March index of 58.1.

- Business conditions – When asked to assess their business conditions over the next four months, 15.4% of the executives responding said they believe business conditions will improve over the next four months, a decrease from 28.6% in March. 26.9% believe business conditions will remain the same over the next four months, down from 53.6% the previous month. 57.7% believe business conditions will worsen, up from 17.9% in March.

- Capex demand – 11.5% of the survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, down from 32.1% in March. 26.9% believe demand will “remain the same” during the same four-month time period, down from 42.9% the previous month. 61.5% believe demand will decline, an increase from 25% in March.

- Access to capital – 7.7% of the respondents expect more access to capital to fund equipment acquisitions over the next four months, down from 21.4% in March. 88.5% of executives indicate they expect the “same” access to capital to fund business, up from 75% the previous month. 3.9% expect “less” access to capital, relatively unchanged from March.

- Employment – When asked, 23.1% of the executives report they expect to hire more employees over the next four months, a decrease from 32.1% in March. 73.1% expect no change in headcount over the next four months, up from 67.9% last month. 3.9% expect to hire fewer employees, up from none in March.

- U.S. economy – None of the leadership evaluate the current U.S. economy as “excellent,” down from 3.6% in March. 88.5% evaluate the economy as “fair,” down from 92.9% the previous month. 11.5% evaluate it as “poor,” up from 3.6% in March.

- Economic outlook – 7.7% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, down from 32.1% in March. 34.6% indicate they believe the U.S. economy will “stay the same” over the next six months, down from 39.3% last month. 57.7% believe economic conditions in the U.S. will worsen over the next six months, an increase from 28.6% the previous month.

- Business development spending – In April, 19.2% of respondents indicate they believe their company will increase spending on business development activities during the next six months, down from 35.7% the previous month. 80.8% believe there will be “no change” in business development spending, an increase from 64.3% in March. None believe there will be a decrease in spending, unchanged from last month.

Survey Demographics

Market Segment

- Bank 54.2%

- Captive 16.6%

- Independent 29.2%

- Other 0%

Market Segments Based on Transaction Size of New Business Volume

- Large-Ticket (New Business Volume Avg. Transaction Size Over $5 Million) 7.7%

- Middle-Ticket (New Business Volume Avg. Transaction Size of $250,000 – $5 Million) 42.3%

- Small-Ticket (New Business Volume Avg. Transaction Size of $25,000 – $249,999) 50%

- Micro-Ticket (New Business Volume Avg. Transaction Less Than $25,000) 0%

Organization Size

- Under $50 Million 7.7%

- $50 Million – $250 Million 19.2%.

- $250 Million – $1 Billion 38.5%

- Over $1 Billion 34.6%

April 2025 Survey Comments from Industry Executive Leadership

Bank, Small Ticket

“New business volume was strong for Q1, and the pipeline continues to trend upward. Although there are many aspects of the market that are uncertain, our customers’ confidence levels remain high and that equates to further investments into their business that, in turn, is good for our industry. We are paying close attention to portfolio performance and while the metrics are still good, they are elevated from previous years. We expect that to remain throughout 2025.” David Normandin, CLFP, President and Chief Executive Officer, Wintrust Specialty Finance

Independent, Small Ticket

“The uncertainty of what tariffs will or will not be put in place, and when, is not helping the economy in the near term.” James D. Jenks, CEO, Global Finance and Leasing Services, LLC

Independent, Large Ticket

“I’m optimistic because demand remains steady to strong at the moment, but I have concerns that at some point the various headwinds will have an impact.” Jonathan Albin, Chief Operating Officer, Nexseer Capital

Back to Top